- April 1st marks the beginning of National Financial Literacy Month to highlight the importance of financial wellness and teach Americans how to establish and maintain healthy financial habits. According to a recent National Financial Capability Study (NFCS), nearly "two-thirds of Americans can’t pass a basic test of financial literacy." As we Black millennials gain more inheritance into the well-being of our future, we must thoroughly be aware of how to budget and save our earnings in the world of personal finance. For better or for worse, money touches all areas of our lives. And without the essential knowledge and skills to manage our money effectively, we fail to capitalize on our successes and achieve a financial freedom well-deserving of our hard work.

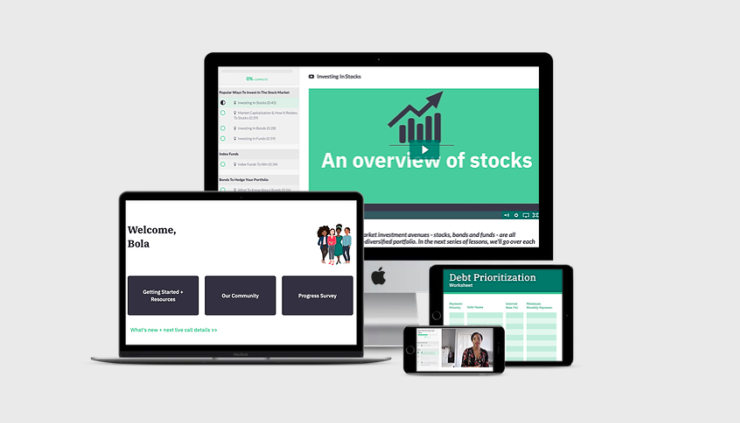

Yet traditionally speaking, women of color have not had access to the proper tools and resources to empower themselves financially. But with the arrival of Clever Girl Finance, women of color being financially illiterate will soon be a thing of the past! Founder and CEO, Bola Sokunbi, created the financial education platform to help minority women "become accountable, ditch debt, save money and build real wealth." By offering informative, online courses, as well as, providing access to a growing community, Sokunbi and Clever Girl Finance allow for women of color to achieve their financial goals.

I had the pleasure to speak with Sokunbi on why it's important for women to be financially literate, what financial courses she recommends for beginners, and how to overcome credit card debt.

- Check out our exclusive interview with Bola Sokunbi below.

Photo: Clever Girl Finance

-

21Ninety: How did the concept for Clever Girl Finance come to be? What inspired you to build a personal finance platform dedicated to educating women about financial wellness?

Bola Sokunbi: The platform was started with my mom in mind. My mom was a stay at home mom — she got married at very young, at 19. And as my mom got older, she started to see things with her friends and her space that she didn't like. For instance, friends would get divorced or, unfortunately, her friends' husbands would pass away, and they wouldn't have anything. They didn't know anything about their personal finances, or the husbands' families would come in and just take over. So, my mom was very motivated to want to do better with her own money and took it upon herself to educate herself — go to college after raising her four kids then started hustling and saving money. Fast forward several years, my family went through a financial downturn when my father had to retire early so my mom stepped in to take care of our family's finances. That's kind of one fold of it.

The second fold of it was going into college of my own and trying to navigate the world. I didn't know anything about money — I didn't know what it was to budget, I didn't know what it was to have 401K. I was never exposed to that stuff. So basically I started reading as much as I could and learning as much as I could. I was able to save over $100,000 three and a half years after I graduated from college. Then fast forward years later again — I got married and had kids — and I started to see the same things that my mom was seeing with her friends. So I decided to start writing about money and my own personal experience involving money, and that's pretty much the beginnings of how Clever Girl Finance got started.

Photo: Clever Girl Finance

21N: Why is it important for female millennials to be financially literate in today’s economy?

BS: Oh my God, it is so important! Money is what opens doors. Money is what gives you options. Specifically, for women, we are in this space where we are graduating from colleges more than our male counterparts. We are also being impacted by the gender wage gap, which means we live longer but we're going to earn less. So we need more money to take care of ourselves over the course of our lives. Many of us are single mothers or sole breadwinners in the family. And a lot of us come from backgrounds where our mothers and grandmothers were not necessarily managing the household finances. We need to get to that point where we are empowered so that we can make the right financial decisions for ourselves and not wait for anybody to save us. At the end of the day, it's just us. So if we want to be able to achieve the dream life that we want for ourselves, if we want our children to be financially secure, if we want to pay off debt and save money, then we have to be able to understand how money works. And we have to use money to our advantage so that we are able to create those options that we want for us to have in life.

-

21N: Clever Girl Finance offers two membership packages — Annual and Monthly — for unlimited access to financial online courses. Which courses would you recommend for women just beginning their financial literacy journey?

BS: We have a course platform, which as you said is monthly and annual, and it's a variety of different courses. For someone who is just trying to figure where to start in their finances, we typically suggest that they start by talking to one of our mentors — who is someone who has been the process and able to guide you based on what their personal, unique scenario is. If paying off debt is one of your biggest concerns, then you might want to take a course on how to set the right financial goals. The next course could then be how to create a debt repayment strategy. The following course could be how to adjust your money mindset so you can get through the journey because once you create the strategy, you have to do the work.

If you want to learn how to create accounts to invest your money, then we have courses based on investing and how to get started. Or if budgeting is something you want to focus on, then we have a few courses to help you with that. So it depends on what your scenario is, but I always say that the best courses to get started with, from a general perspective, is the course on adjusting your mindset because achieving your financial goals is a long-term thing and you have to be mentally prepared to go through the journey.

Photo: Clever Girl Finance

-

21N: In addition to having access to 30+ education courses, women can also pre-order the Clever Girl Finance: Ditch Debt, Save Money and Build Wealth book. When is the book due to release? And what can women expect to gain when purchasing the book?

BS: Yes! So the book comes out on June 25th. It's going to be in book stores, on Amazon, on Audible — and it's a practical guide to help women save money, ditch debt, build wealth. In the book, I go over everything from my personal story to sharing the stories of other successful women who have done amazing things with just a little. We talk about all the things you need to create a solid foundation for your finances: how to pay of debt, how to budget, how to apply for retirement, how to negotiate your salary, how to start thinking about increasing your income through a side-hustle. So it's a very practical and actionable book. And it's also inspiring because I'm sharing personal stories, so that who's ever reading it realizes that they aren't alone. There are other people just like them who have gone through what they're going through, or who are currently going through what they're going through. If they can succeed, then so can the reader.

Photo: Wiley x Clever Girl Finance

-

21N: As a Certified Financial Education Instructor, money expert and the CEO and founder of Clever Girl Finance, what has been the most rewarding aspect since launching Clever Girl Finance?

BS: Getting to meet and getting to interact with the people who Clever Girl Finance has helped. Knowing that what we're doing is making a difference and positively impacting women's life — that is the biggest reward.

-

21N: Beginning on April 15th, you will lead a 7-Day Financial Literacy Challenge to provide our subscribers with informative and actionable financial wellness tips to incorporate in their financial journeys. One tip, in particular, subscribers can expect to learn involves prioritizing debt and determining a plan of action — what was your plan of action to achieving debt freedom?

BS: The first debt I had was in college. It was credit card debt. And I paid that off in fear of my mother killing me [laughs]. But also the motivator there was the interest rate — it was about a 25% interest rate. It's the most ridiculous thing that I was paying a quarter of my balance, so that is what drove me. Whatever little money I was saving from my part-time college job, I put that on hold and really focused on paying down that debt. It wasn't a lot of money that I owed — I think it was about $2,000 — but it might as well have been a million because, at the time, I was only earning $150 every two weeks. How will I ever pay this off? Ever since then, I've sort of stayed away from credit cards. Now I use a charge card, which requires me to pay my balance in full every month.

21N: Yeah, I have some credit card debt of my own that I really need to get rid of [laughs].

BS: [laughs]. It's about prioritizing it. One of the best things to do is to pull all of your interest rates. Then there are two ways you can pay it off — you can pay off your debt that has the smallest balance, regardless of the interest rate. And when you focus on paying off the debt with the smallest balance, you're going to get quick wins. Like, I paid off the $500 one or I paid off the $100 one or I paid off the $1,000 one. As human beings, we thrive off of wins and knowing that we're making progress. So that's one way.

The other way would be to take those credit cards and prioritize them by the highest interest rate. And when you're prioritizing by the highest interest rate, you're going to save the most amount of money and interest payments. And then, for that highest interest rate credit card, you pay as much as you can that's more than the minimum every month. Once that's gone, you take all of that extra money you are paying — including that minimum — and then you put towards the next credit card.

-

21N: Wow, thank you! That's very informative and I'm sure it'll help many of our readers. Along with your financial knowledge, you'll also be joining us at our 2019 Summit21 Conference to speak on your incredibly, trailblazing success story to continue inspiring others. Who are some influential, Black entrepreneurs that inspire you?

BS: Oh my God, well, everybody loves Oprah [laughs]. So I have to put her name out there too. I also love Michelle Obama. I love Karen Civil. I love Monique Nelson, she is the CEO of UniWorld Group, which is the first multiethnic marketing group. She is amazing!

Photo: Summit21

21N: Do you have any final words of advice or encouragement for Black women struggling to thrive in their financial wellness journey?

-

BS: Yes! When you look at the general consensus with people who are talking about money, they make it seem like you're just going to have to struggle to achieve anything. And yes, that's true, you will struggle. You're going to have to put in the work. It's going to be hard and uncomfortable, but while you're doing it, you can still enjoy the process. And you can still live a good life. And you can still be happy about the journey that you're taking. So I always tell women to choose to be happy, adjust your mindset, and get into it for the long haul. As you're going through the financial journey of paying off thousands of debt, understand that it's okay to enjoy yourself. You can still go get your hair done. You can still go get your nails done. You don't have to live the struggle life to become successful, but you have live within reason that is not impacting these goals you have set for yourself.

Always remember your why. Why do you want to pay off the debt? Why do you want to save all that money? Once you figure out your intent, that will be the motivator that keeps you going.

-

Ready. Set. Boss. Our daily email is pouring out inspiration with the latest #BlackGirlBossUp moments, tips on hair, beauty and lifestyle to get you on track to a better you! Sign up today.