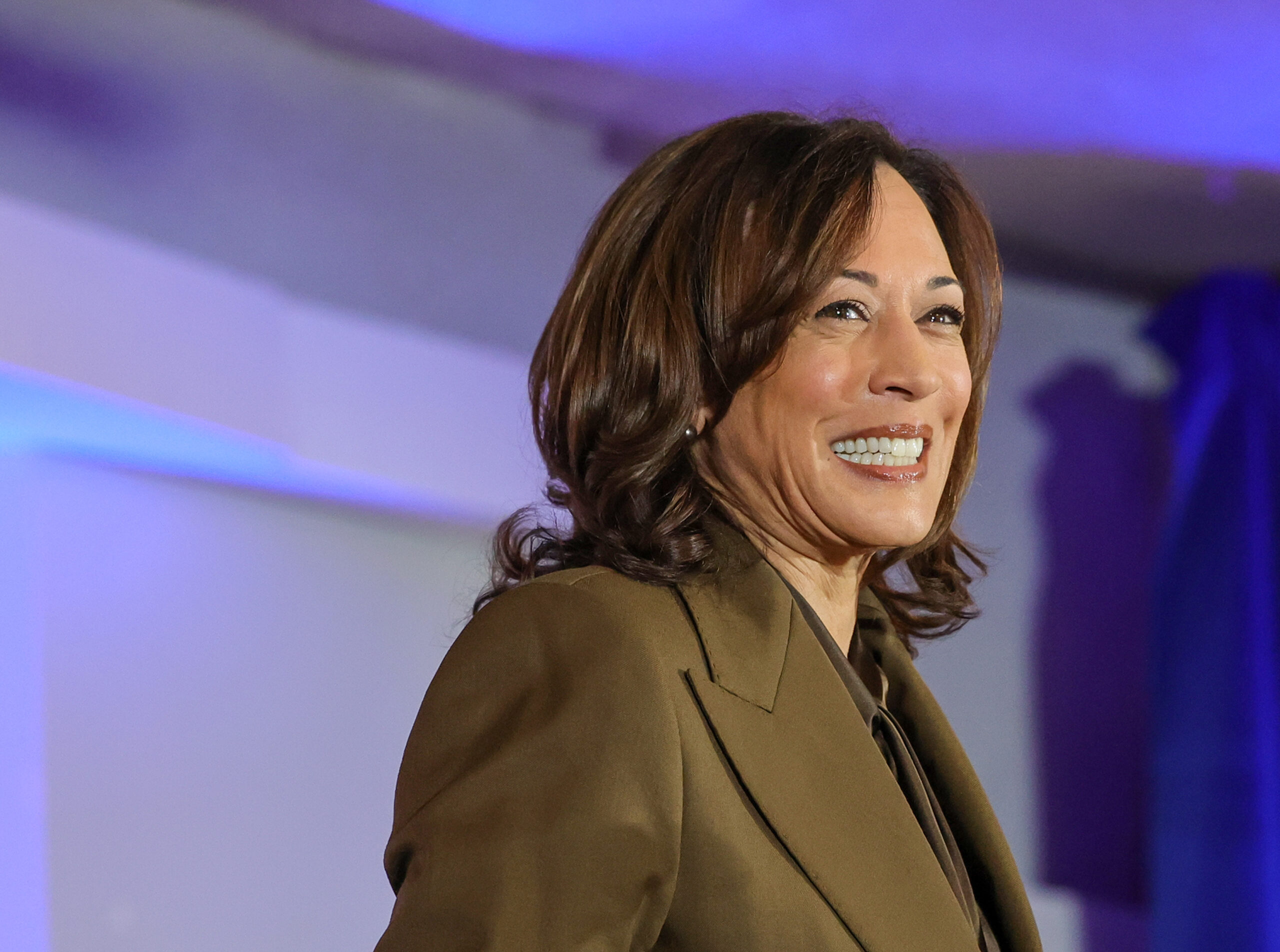

Kamala Harris is known for good hair days and now she's dishing all the details of her hair journey in a new interview.

Get the 21Ninety Newsletter

Get More Culture Content

Subscribe to 21Ninety, a free daily newsletter that features the best of culture, internet, and wellness guides from a new point of view — yours.

By subscribing to this newsletter, you agree to our terms of service and privacy policy.