If you are like me, you know this about financial planning: Time is still on our side, but only if we make the right choices with our money, starting immediately.

Building the resources you need to help you accomplish what you want in life isn’t complicated, but the sooner you start a financial plan, the better off you’ll be — trust me.

In my early 20's, when I first started living on my own, I found more and more that I was living paycheck-to-paycheck. I know I can't be alone in this right? So, that’s why this year I have decided that before I do anything else, I will stop doing that.

It's important to figure out where you can start cutting costs, even its only $5 every week. The best way to do this is to start tracking where you are spending your money. That way you can make changes and set goals around your spending.

So, if one of your goals this year is to save more cash, then why not try a budgeting app?

No longer do we need a pen and paper or a calculator to track our budget when an app can easily take out all the guessing and do the work for us.

In this day and age, there are phone-based expense tracker apps that can take you to a whole new level of financial knowledge.

Here are five apps to help get you started:

1. Dave

Photo: Dave

Dave is an interestingly crafted app that helps you budget for upcoming expenses, and texts you if you’re in danger of overdraft. If you are feeling crushed by overdraft fees in your 20s and need a cash advance before payday, it can help you out with that too.

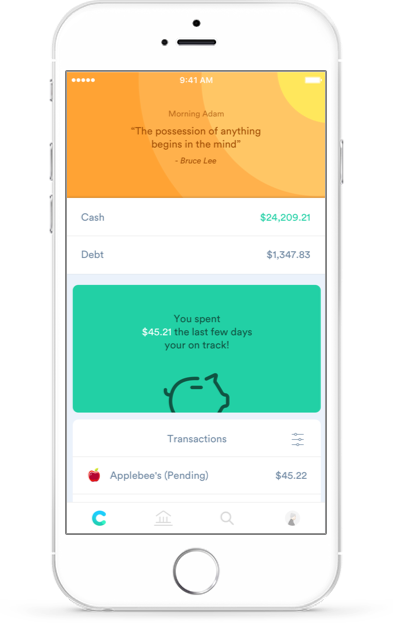

2. Clarity Money

Photo: Clarity Money

Clarity Money is designed as a financial app with both online and mobile interfaces. It gives you highlights of your recent account activity and spending. Another cool feature tracks your spending each month with your expected monthly income. As if you needed even more of a reason to download it, the app also includes options to cancel music or streaming subscriptions, track your credit score and automatically add to savings (through a specific Clarity Money account) consistently.

3. Wally

Photo: Wally

If you are looking for a more technology-friendly app, try Wally. This integrative app provides insights into your spending habits with a big focus on expenses. It presents feedback and useful information on your spending, but it also has a social feature (a-la Venmo) for shared costs. When you add in the trendy graphics and social functions, you have something many of us will millennials will enjoy.

4. Digit

Photo: Digit

If you are looking to save money without even trying, then Digit is for you. Digit analyzes your spending and automatically saves the specified amount every day, so you don't have to give it a second thought. Whether you are saving up for a trip, emergency fund or paying down those student loans, even if its just a couple cents daily, the savings will add up.

5. Mint

Photo: Mint

We can't end this list without talking about Mint, one of my favorite personal finance tools to use. Mint is an excellent addition to your apps because it is free, supports a wide range of banks and lenders and comes from a reputable financial software, Intuit. Take charge of your finances and keep track of all of your accounts (phone bill, car payment, insurance) all in one place.

Ready. Set. Boss. Our daily email is pouring out inspiration with the latest #BlackGirlBossUp moments, tips on hair, beauty and lifestyle to get you on track to a better you! Sign up today.